The Importance of Business Process Mapping in SOX Compliance

Adherence to the Sarbanes-Oxley Act (SOX) in the contemporary business landscape is non-negotiable. Instituted in 2002, SOX aims to increase transparency and accountability within publicly traded companies, thus fostering trust among stakeholders. Achieving and maintaining SOX compliance is a structured process that demands a well-considered strategy. Below are the pivotal steps companies should undertake on the road to SOX compliance.

Today, many in the business world hear the term "SOX," their minds immediately leap towards clearly planned and mapped-out accounting processes to mitigate fraud wrongdoing and provide greater accountability and transparency in publicly traded organizations.

What is Sarbanes Oxley (SOX) compliance?

SOX requires that publicly traded companies listed on U.S. exchanges put controls in place to address the potential of fraud in financial reporting. Like many compliance requirements, SOX compliance is time-consuming and costly for the organization. Anybody in your organization's internal audit department can tell you exactly how much time they've spent putting together these reports to explain the organization's internal controls and accounting policies.

These internal control and accounting policy requirements assist the organization in streamlining accounting procedures and enable the organization to respond to potential incidents of fraud and financial misstatements with greater agility. However, compliance within SOX doesn't have to be a frustrating maze of seemingly disconnected and unrelated organizational procedures and policies.

Decisively mapping out the organization's business and accounting processes to communicate clearly with its internal and external auditors can assist the organization in understanding and changing its current processes to remain compliant with Sarbanes-Oxley.

Importance of complying with SOX regulations

Complying with SOX regulations is essential for several reasons. Firstly, it helps ensure the accuracy and reliability of financial reporting, giving stakeholders confidence in the company's financial statements. Secondly, establishing stringent control measures helps prevent fraud and unethical practices. Lastly, SOX compliance is mandatory for all publicly traded companies, and non-compliance can result in severe penalties and reputational damage.

How does SOX compliance affect businesses?

SOX compliance significantly impacts businesses, particularly those subject to its regulations. It requires companies to establish and maintain robust internal controls over financial reporting processes, which can be time-consuming and resource-intensive. Compliance also involves working closely with external auditors to ensure that control documentation and testing meet the requirements set by the PCAOB (Public Company Accounting Oversight Board).

SOX compliance audit and reporting

While SOX has a legacy of twenty-two years, it is not static. In the past few years, the Public Company Accounting Oversight Board (PCAOB) has been putting pressure on external auditors to require greater control over end-user computing (e.g., spreadsheets), as well as requiring process maps and flow diagrams - in addition to the lengthy written control narratives.

As a result, external auditors require written narratives of the organization's internal controls over financial reporting (ICFR) that are supported by detailed process flow diagrams.

These show how the process works visually and the risk and control points within that process. The lack of this documentation of your organization's internal controls over financial reporting calls into question your organization's ICFR processes.

It leaves room for an auditor to determine that they need more detailed process documents to form an opinion on internal controls' design and operating efficacy.

How to handle SOX requirements

Overall, to remain compliant, it is essential to:

- Illustrate the organization's accounting and business processes by mapping and documenting them.

- Provide a framework of operational proof that the organization mitigates the risk of any potential actions of fraud or misconduct.

Not only does this allow the organization to streamline accounting processes and procedures, but it can also allow for the organization to:

- Identify redundancy in internal controls.

- Update procedures more efficiently and quickly

- Mitigate potential risks by closing loopholes or cracks within the organization's controls and procedures.

- Ensure that the organization holistically approaches internal controls.

- Educate relevant stakeholders' understanding of business processes and controls.

- Simplify processes and make them more accessible for review.

- Monitor internal control and risk points visually within business processes through dashboards on the process.

This allows the organization to handle SOX requirements more efficiently, providing auditors with a clear overview of internal controls over financial reporting. It also assists in demonstrating a clear intent to mitigate potential fraud and misconduct.

Leveraging business process modeling for SOX compliance

It is paramount for organizations to leverage technology to improve efficiency, agility, and effectiveness in SOX compliance efforts and procedures. This regulation significantly expands the scope and responsibility of the organization's ICFR.

Approaching this through siloed, non-agile manual processes is a nightmare scenario for managing and reporting in a way that fails to give auditors a clear view of the organization's ICFR. Some organizations find that their internal control and SOX compliance teams spend 80% of their time managing documents and not improving compliance.

However, a technology architecture for SOX compliance that supports business process modeling leaves you with a more efficient, agile, and effective SOX compliance framework. It allows business processes to be tracked and mapped to provide a clear understanding and justification for internal controls within the organization's accounting and financial reporting processes.

Organizations need to leverage a SOX compliance technology architecture to make internal controls documentation and mapping of accounting processes more efficient and effective in meeting SOX requirements and achieving greater visibility in the organization's ICFR fully.

This requires that organizations address the overall requirements within Sarbanes-Oxley and the pressure on external auditors by leveraging technology to make these compliances efficient and agile – and to reduce time and cost.

SOX is just a start; many other compliance obligations also require business process modeling. Privacy regulations such as the EU Global Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) also require business process modeling to define how information flows and is used within organizations. Selecting the right technology that supports business process modeling can provide an infrastructure for SOX compliance and many other regulatory obligations organizations face.

SOX Steps to Compliance

- Understanding SOX Requirements:

Before embarking on the SOX compliance journey, it's imperative to clearly understand the SOX requirements and how they relate to your organization. Engage legal and financial advisors to ensure a comprehensive understanding of the legislation. - Risk Assessment:

Conducting a thorough risk assessment will help identify areas of non-compliance and potential issues that could arise in the future. Engage with a SOX compliance consultant to ensure a thorough examination of potential risks. - Implementing Control Frameworks:

Establishing a robust internal control framework is at the heart of SOX compliance. Adopt frameworks like COSO or COBIT to address all SOX compliance requirements comprehensively. - Documentation and Testing:

Documenting your control procedures and testing them regularly is crucial for maintaining compliance. Utilize SOX compliance software to streamline the documentation and testing processes. - Training and Awareness:

Conduct regular training sessions to keep staff updated on SOX compliance requirements and the importance of adherence. Promote a culture of compliance within the organization to ensure long-term adherence to SOX regulations. - Continuous Monitoring and Review:

Establish a continuous monitoring program to review the effectiveness of your control frameworks—leverage technology to automate monitoring and ensure real-time compliance. - Engage External Auditors:

Employ reputable external auditors to conduct independent audits of your SOX compliance processes. Foster a collaborative relationship with auditors to ensure that any issues are identified and addressed promptly. - Remediation:

In the event of non-compliance, have a clear remediation plan to address issues promptly and effectively.

Continuously improve your SOX compliance processes based on the findings from internal and external audits.

Benefits of using business process modeling in SOX compliance

Business process modeling offers several benefits when it comes to achieving SOX compliance. One of the key advantages is the ability to identify critical control points within a process.

By visually mapping out the steps and activities, businesses can quickly identify the controls needed to ensure the accuracy and integrity of financial reporting.

Best practices for business process modeling in SOX compliance

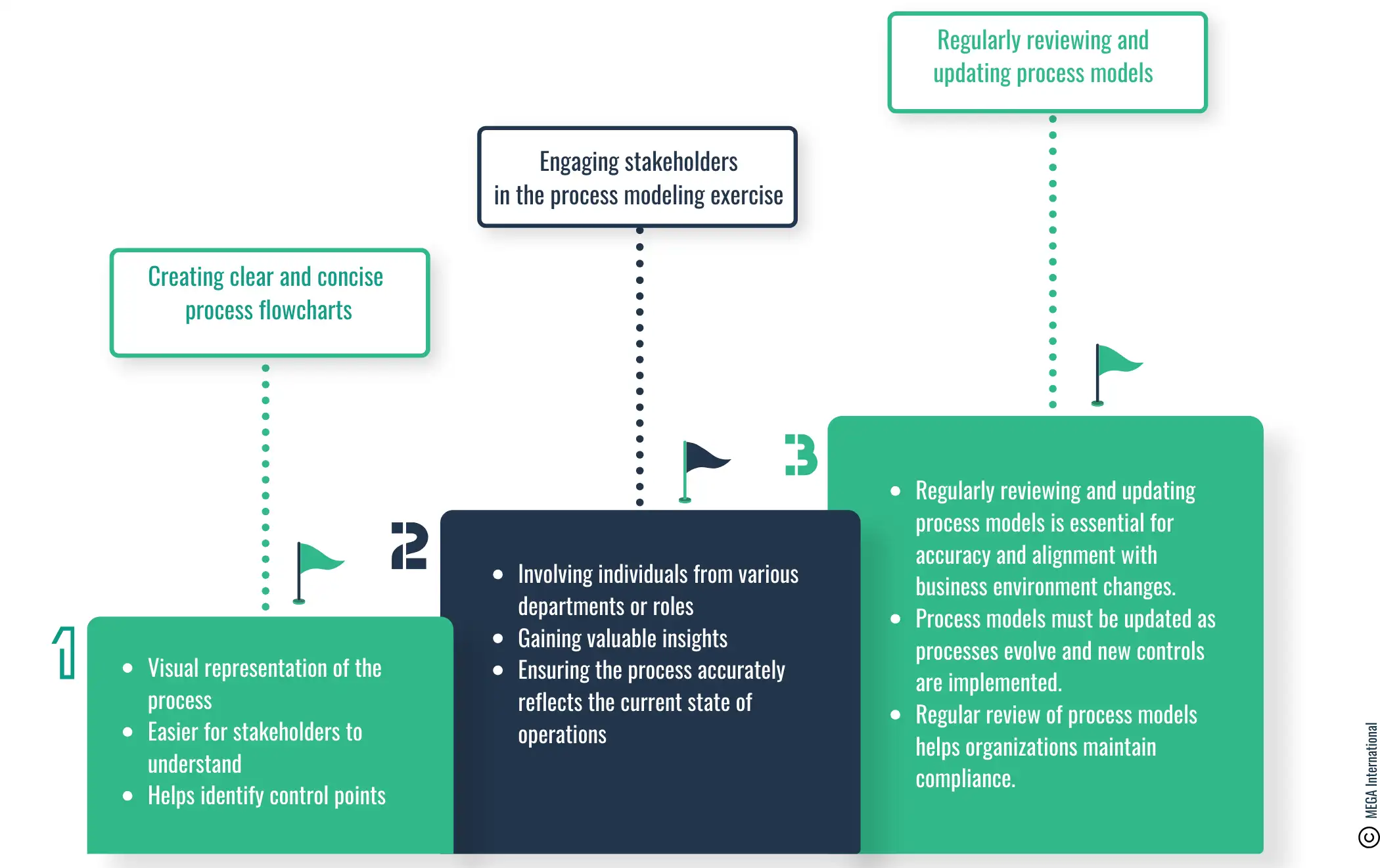

Creating clear and concise process flowcharts

One of the best practices for business process modeling in SOX compliance is the creation of clear and concise process flowcharts. Flowcharts visually represent the process, making it easier for stakeholders to understand and identify control points.

Engaging stakeholders in the process modeling exercise

Engaging stakeholders throughout the process modeling exercise is another best practice. By involving individuals from various departments or roles, organizations can gain valuable insights and ensure that the process accurately reflects the current state of operations.

Regularly reviewing and updating process models.

Regular review and updating of process models are essential to ensure that they remain accurate and aligned with changes in the business environment. Organizations should update their process models to maintain compliance as processes evolve and new controls are implemented.

Common challenges in business process modeling for SOX compliance

Lack of resources and expertise

One common challenge in business process modeling for SOX compliance is the need for more resources and expertise. Developing and maintaining comprehensive process models can be resource-intensive and require specialized knowledge of the mapped process and compliance requirements.

Managing changes and updates in processes

Another challenge is managing changes and updates in processes. As businesses evolve, processes may change, rendering existing process models outdated. It is crucial to have mechanisms to efficiently capture and update these changes to maintain accurate process models and compliance.

Ensuring consistency and accuracy in process modeling

Ensuring consistency and accuracy in process modeling can be challenging, especially in large organizations where multiple individuals may be involved in the modeling exercise. Establishing clear guidelines and quality control processes is essential to ensure that process models are consistent and accurately reflect the actual processes.

Importance of business process modeling in achieving SOX compliance

In conclusion, business process modeling is crucial in achieving SOX compliance for publicly traded companies. By visually representing and analyzing business processes, organizations can identify critical control points, streamline compliance processes, and enhance transparency and accountability.

By following best practices such as creating clear process flowcharts, engaging stakeholders, and regularly reviewing and updating process models, organizations can maximize the benefits of process modeling in managing internal controls and achieving compliance with SOX requirements.

It's essential to recognize that the compliance landscape continues to evolve, and organizations must continuously improve and adapt their process modeling efforts to meet new regulatory requirements and emerging industry best practices.

FAQs

SOX compliance refers to the adherence of publicly traded companies to the regulations outlined in the Sarbanes-Oxley Act (SOX). This act was passed to protect investors and enhance the reliability of financial reporting by establishing guidelines for internal controls within organizations.

Business process mapping is the visual representation and documentation of a company's processes and activities. It involves creating detailed flowcharts or process diagrams to illustrate how the different steps in a business process are interconnected.

Process mapping is crucial in SOX compliance as it helps identify and document the internal controls needed to ensure accurate financial reporting. It allows organizations to understand their processes, identify potential risks, and implement adequate mitigation controls.

By mapping their processes, organizations can identify critical controls within each process, document control documentation, and assign process owners. This enables them to meet the specific compliance requirements outlined in SOX, such as internal controls over financial reporting, control testing, and the establishment of effective internal audit procedures.

Several tools and methodologies are available for business process mapping, including process flowcharts, flowchart software, and process modeling techniques. These tools help organizations visualize and document their processes clearly and structure.

During SOX compliance audits, business process mapping provides auditors with a clear understanding of the organization's processes, controls, and how they contribute to financial reporting. This assists auditors in evaluating the effectiveness of internal controls and identifying any deficiencies or gaps that need to be addressed.

The responsibility for business process mapping in SOX compliance typically lies with an organization's internal audit team or compliance department. However, process owners and other stakeholders involved in the processes should also contribute to the mapping process.

Governance, Risk and Compliance Related Content

Enhance operational resilience using integrated risk management

MEGA HOPEX for GRC

Request a demonstration of HOPEX for GRC, and see how you can have immediate value of your projects.